Is Your Credit Union Falling Behind?

HERE’S HOW OUR CLIENTS ARE LEADING THE PACK

Setting the Stage

The competitive and economic landscape for credit unions continues to present challenges in attracting and retaining members. How a credit union positions itself and tells its story is critical to its success. Choosing the right partner to assist in your marketing efforts can make all the difference.

As the digital landscape evolves rapidly, credit unions that embrace modern strategies are gaining a competitive edge and succeeding. One of the key advantages is using digital forms embedded directly into websites—streamlining member interactions, reducing friction in applications, and significantly improving member experience and operational efficiency.

Why Digital Matters More Than Ever

Digital Banking Usage

According to the Federal Reserve’s 2021 Consumers and Mobile Financial Services study, more than three-quarters of U.S. adults use some form of digital banking—a number that continues to grow each year.

Membership Growth

In an analysis from Callahan & Associates, credit unions that invested heavily in digital transformation saw, on average, a 12–15% higher membership growth rate

compared to peers who delayed those initiatives. The 2022 BAI Banking Outlook noted that nearly 40% of new checking accounts at community financial institutions were opened through digital channels—a strong indicator that online experiences are vital for attracting new members.

Operational Efficiency

A McKinsey study found that organizations digitizing processes (e.g., embedded online forms, automated onboarding) can reduce operational costs by up to 20–30% in certain areas.

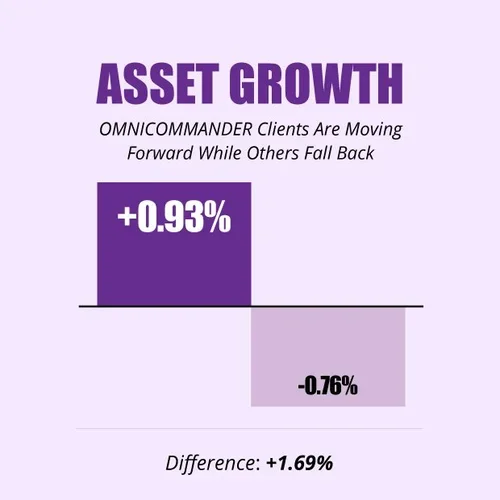

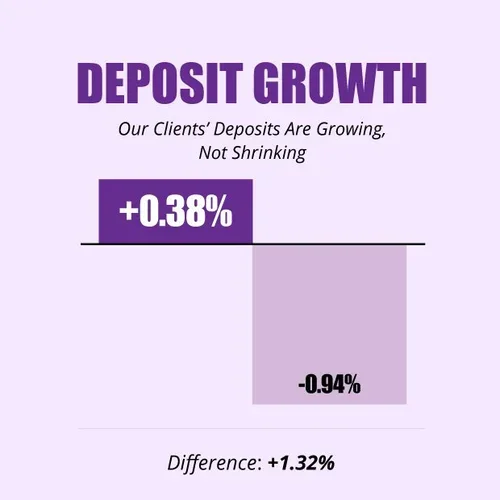

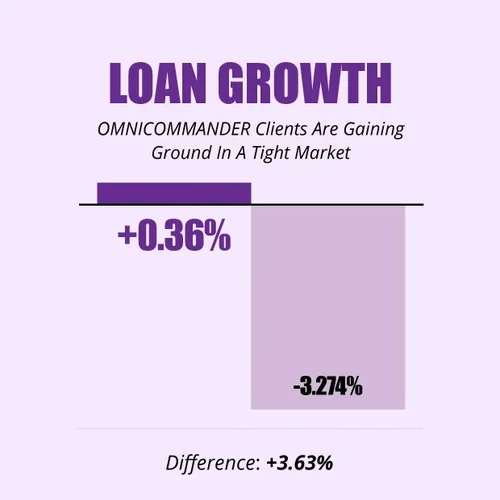

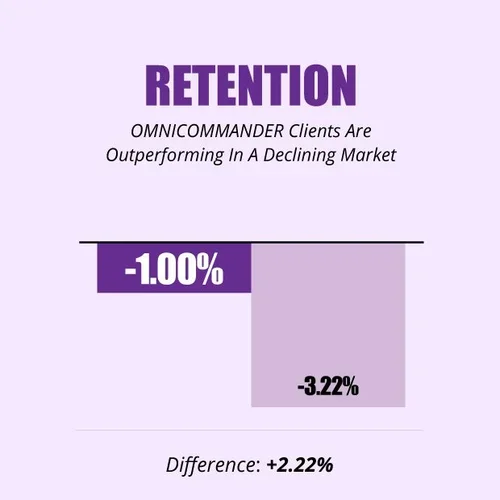

How We Analyze the Data

To understand the real impact of a modern digital strategy, we pulled data from the NCUA and compared our clients to the rest of the industry within the same Peer Groups. The data takes all the OMNICOMMANDER clients and tracks their performance Year over Year (end of 2023 and end of 2024, based on what they reported to the NCUA) and then pulls our clients out of the rest of the Peer Groups to compare. Specifically, we gathered data on these two groups:

PEER GROUP 4

Credit unions with $50 million to $100 million in assets.

PEER GROUP 5

Credit unions with $100 million to $500 million in assets.

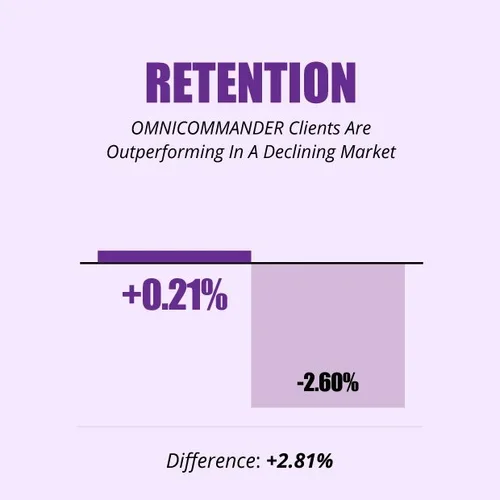

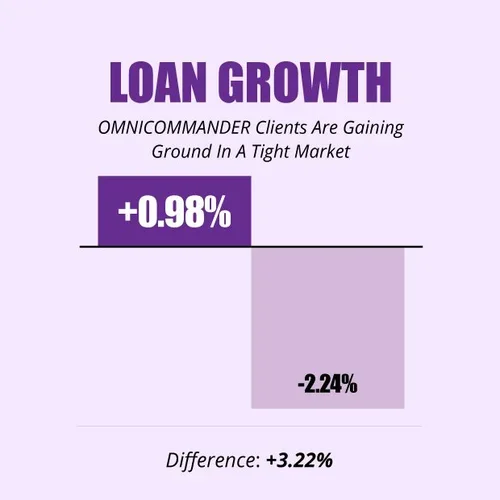

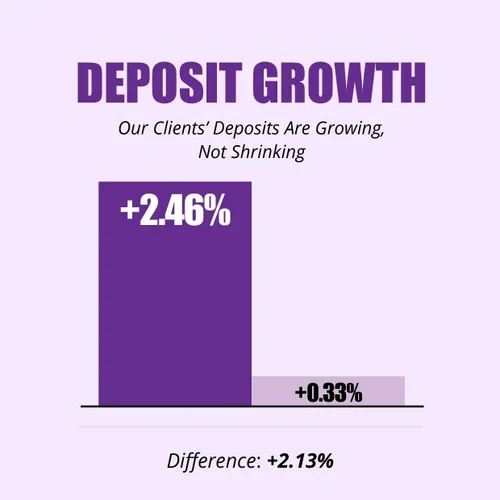

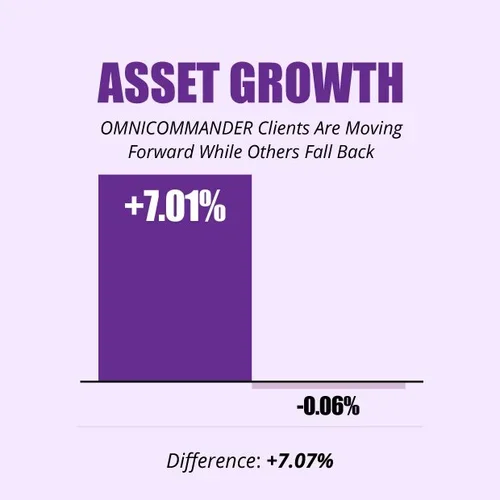

By looking at each Peer Group separately, we can see how OMNICOMMANDER credit unions stack up against their peers on key metrics like asset growth, loan growth, share growth, and membership growth.

Performance Stats:

PEER GROUP 4

$50M - $100M

Using publicly available data from the NCUA, we first analyzed the performance of Peer Group 4 credit unions from 2023 to 2024. For credit unions in this Peer Group, OMNICOMMANDER has partnered with approximately 18% of the total.

Total Credit Unions: 607

OMNICOMMANDER Clients: 109

PEER GROUP 5

$100M - $500M

Building on the data we gained from Peer Group 4, we also looked at Peer Group 5 credit unions from 2023 to 2024. OMNICOMMANDER has partnered with approximately 12% of this group.

Total Credit Unions: 1,058

OMNICOMMANDER Clients: 126

What We’re Seeing in the Rest of These Peer Groups

As we examine the websites of credit unions in both Peer Group 4 and Peer Group 5 that aren’t OMNICOMMANDER clients, a common thread emerges: Many are neglecting their digital presence.

Outdated websites that haven’t been updated in years

Non-mobile responsive designs in a mobile-first world

Broken plugins (yes, Adobe Flash still shows up)

Inaccurate or outdated rates and information

Broken links, poor user experience, and a lack of accessibility compliance

Some of these websites are well over 10 years old—in an age where technology, design trends, and member expectations evolve constantly. When you see this big of a statistical chunk of credit unions in these Peer Groups (18% of PG4 and 12% of PG5) outperforming the rest, it’s not luck—it’s leadership. These credit union CEOs understand that growth starts online. To be clear, we are not stating that every non-OMNICOMMANDER client isn’t performing well. Several of these credit unions are killing it. When we look at those outperformers, they are all embracing their digital channels. The point we are making is that as a total Peer Group, the numbers are unmistakable.

What’s Driving the Outperformance? Coincidence—or a Competitive Edge?

Is it a coincidence that these groups of credit unions have embraced:

Mobile-responsive, modern websites that convert and engage

ADA-compliant digital experiences that serve all members

Forward-thinking digital marketing strategies that bring in new members

Digital forms embedded directly into websites for seamless member experiences

A culture of innovation, data-driven decisions, and execution

This isn’t cherry-picked data. It isn’t a one-off case study. This is a large, validated sample set across multiple asset ranges, and the performance trend is clear: OMNICOMMANDER clients are leading.

So, Here’s the Real Question:

What is it about OMNICOMMANDER credit unions that are separating them from the rest?

While many institutions are holding on to outdated digital tools and legacy thinking, our clients are building momentum—and pulling ahead—across multiple Peer Groups. With data now spanning both Peer Group 4 and Peer Group 5, the conclusion is even more compelling: a modern, optimized digital presence is not optional—it’s the new baseline for competitive performance in the credit union space.